besides cook county taxes what other taxes to home owners have to budget for?

Since 1996, total property revenue enhancement extensions in Illinois have increased 52 percent after adjusting for inflation. This increment took Illinoisans' property revenue enhancement burden from effectually the national average to amidst the highest of any land.

Over 6,000 local taxing districts are responsible for raising these property taxation levies, including schoolhouse districts, special districts, municipalities (cities, towns and villages), and park districts.

Families beyond Illinois have felt the pain of these increases. But what many Illinoisans may not realize is that much of the rising in their property taxes tin be attributed to spending on authorities-worker pensions far outpacing spending on state and local services.

Analysis of state and local government records over the concluding two decades reveal virtually of the property revenue enhancement increase between 1996 and 2016 was caused past:

- State education funds existence diverted to teachers' pensions

- Growth in local authorities employee pensions and benefits

- Expanded local regime spending – which includes additional payroll, increased salaries and added services

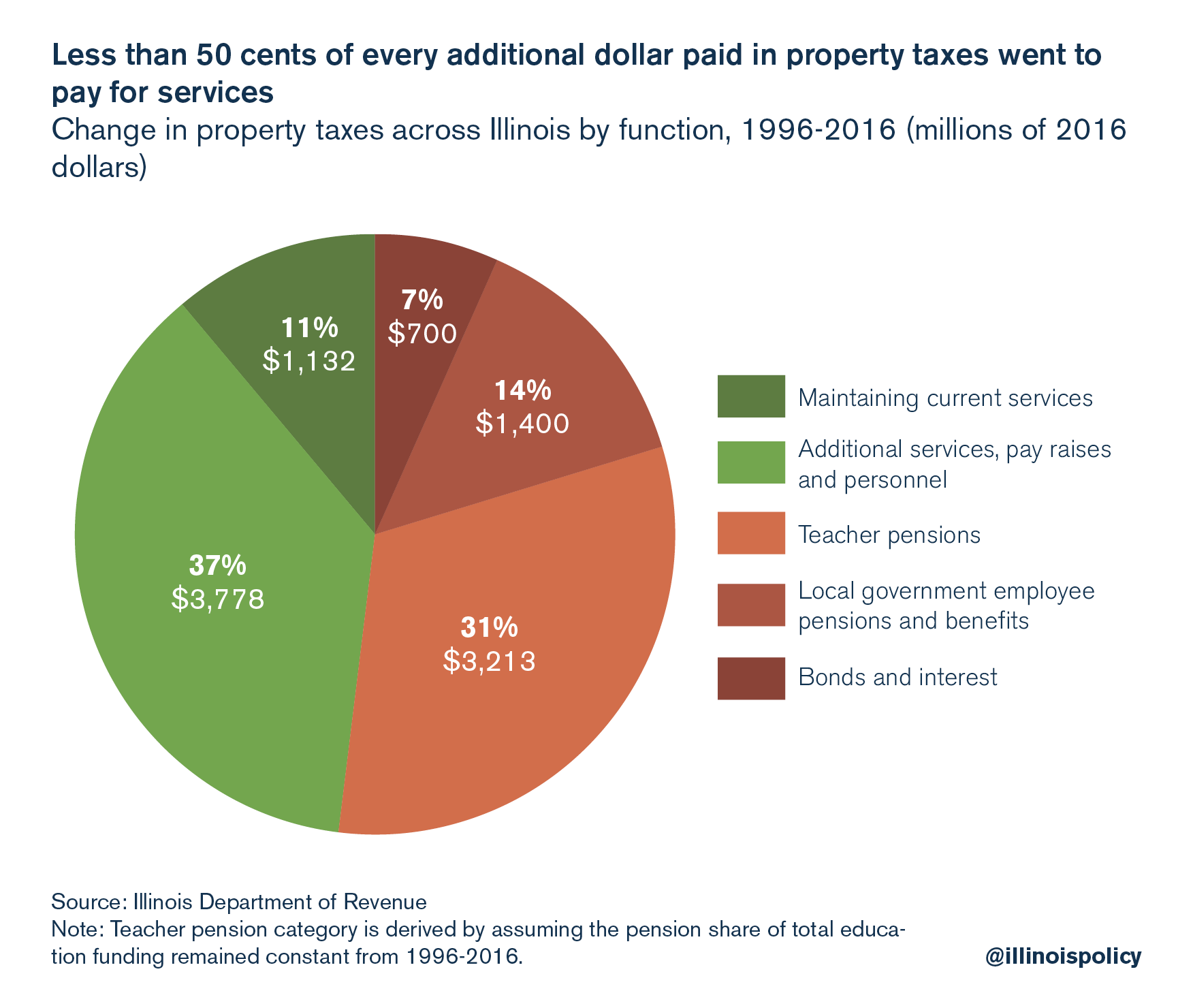

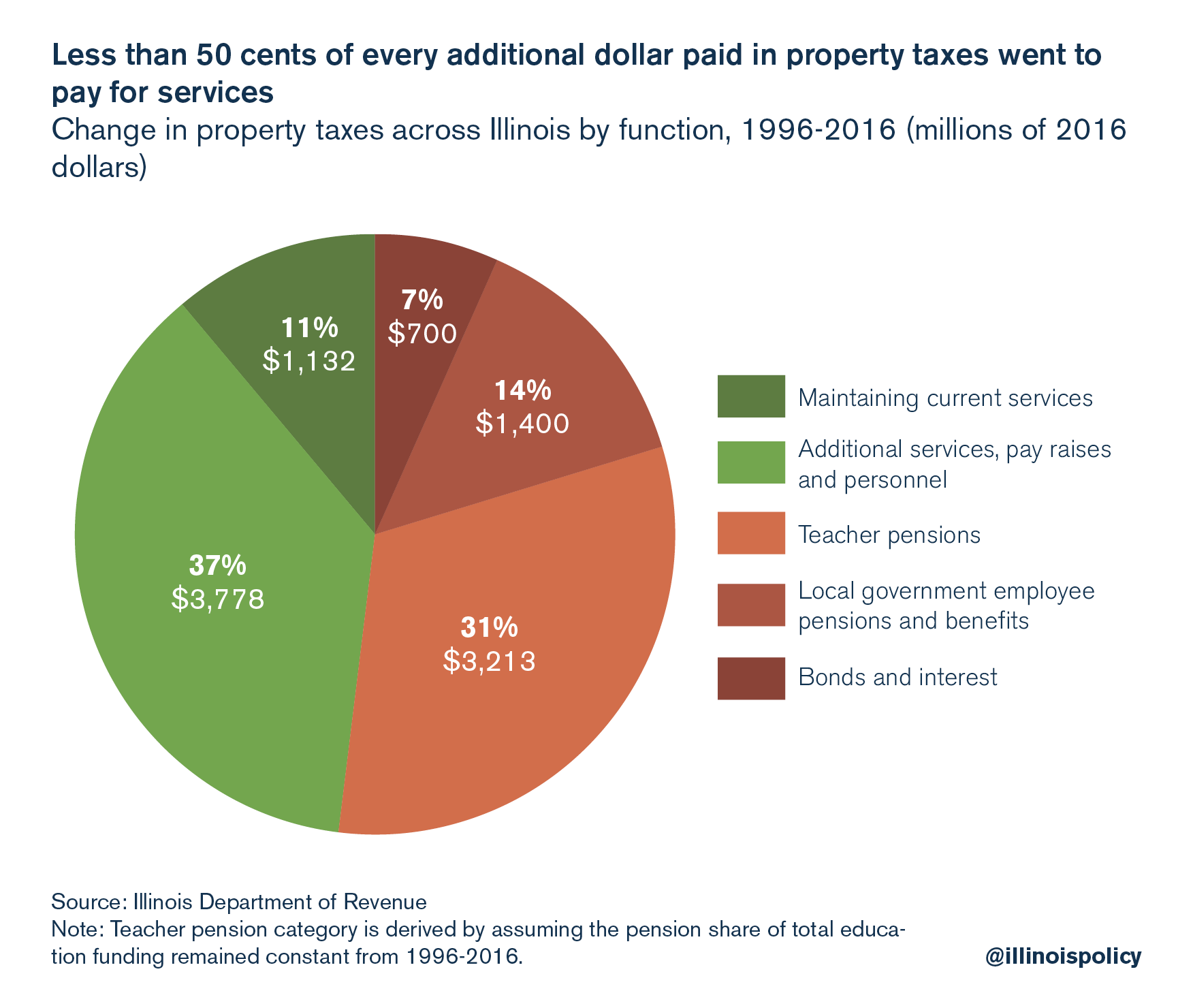

Traditionally, residents look property taxes to fund services that amend neighborhoods and raise abode values. Instead, this report finds that less than one-half of every boosted dollar levied in property taxes since 1996 went to the delivery of services that amend home values.

Pensions vs. education

Analyzing the ascension in Illinois teaching spending is crucial when examining Illinois belongings taxes, because some politicians merits a lack of state spending is to blame for why homeowners see such high property taxes. Without context, this merits is misleading.

Country funding for schools does explain much of residents' high property tax burden, just the key question to consider is: Where is that coin going? In Illinois, although teachers and school administrators aren't state employees, the land government is required to make contributions to the Teachers' Retirement System. Government information show billions of additional dollars in land teaching spending over the terminal 20 years has flowed disproportionately to TRS rather than the classroom, putting pressure level on local governments to option upward the slack.

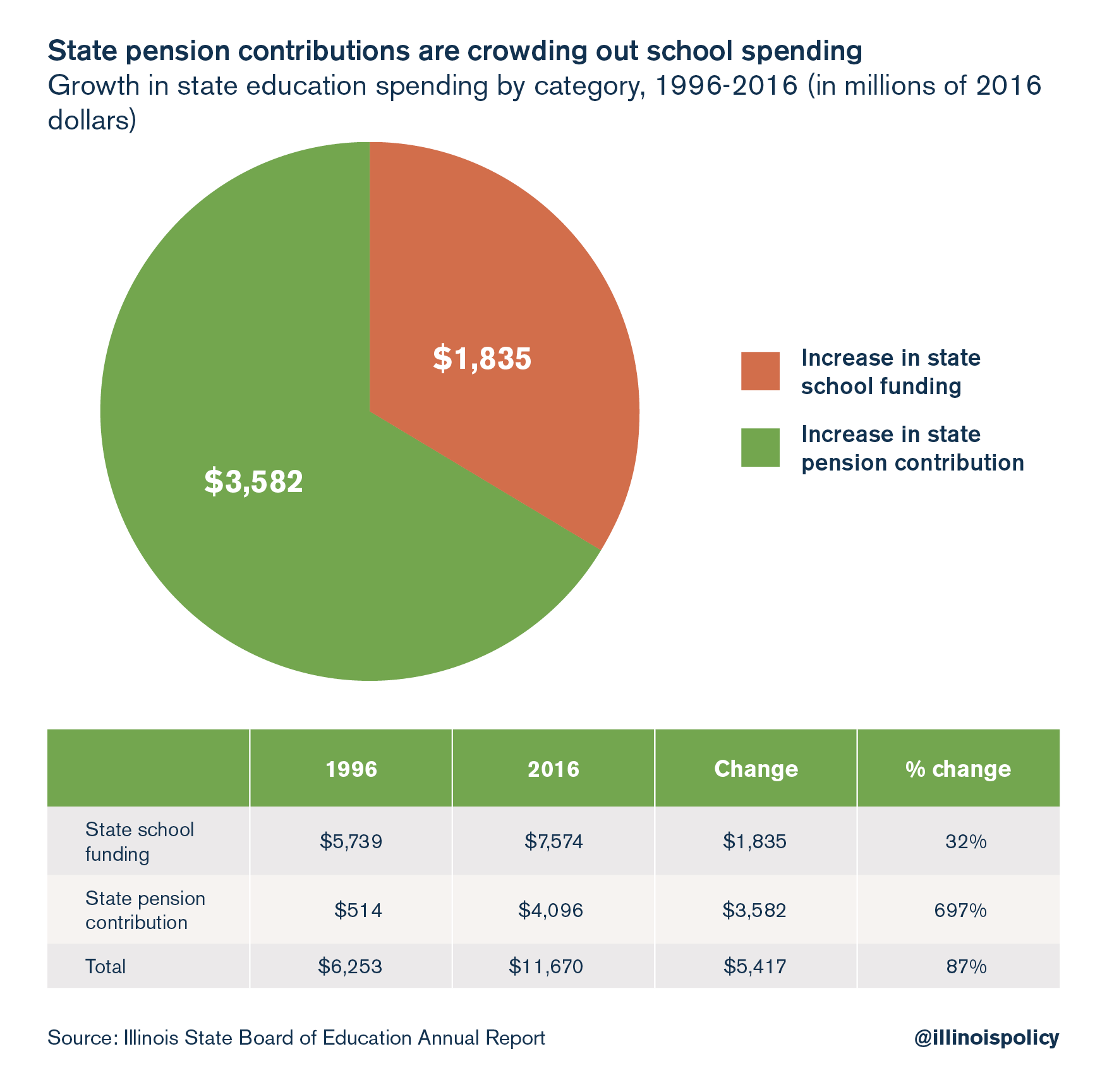

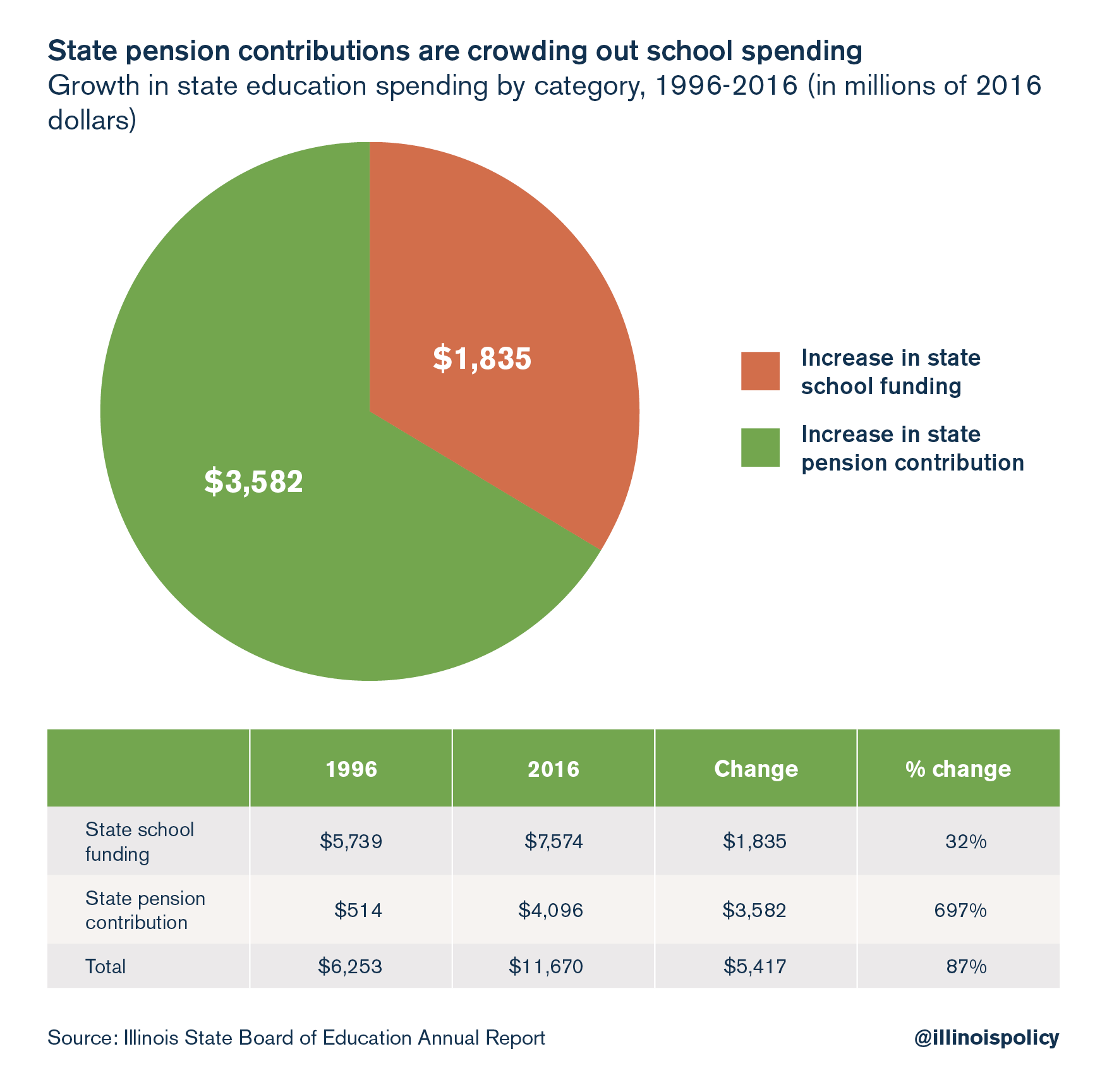

The state'southward contribution to education increased more than $5.4 billion from 1996 to 2016, an 87 percent jump. But 66 pct of that increase – $3.6 billion – went to teachers' pensions instead of the classroom. Adapted for aggrandizement, holding taxes for schoolhouse districts went up 66 percent during this time, according to the Illinois Department of Revenue. Much of that increased belongings taxation burden could have been avoided had the land'south pension contributions gone to classrooms instead.

Pensions vs. public safety

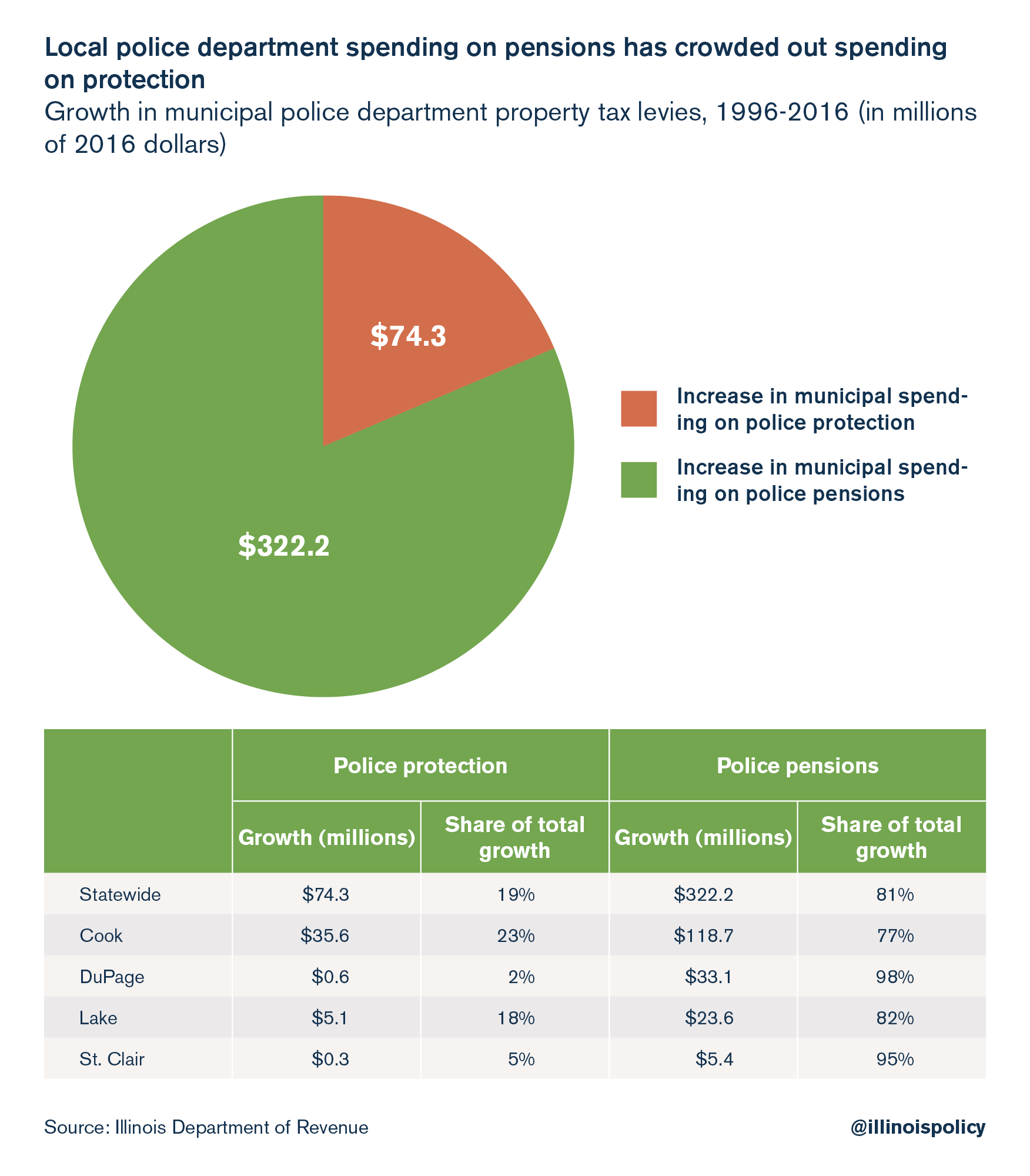

Municipal property revenue enhancement levies explicate the side by side largest share of the rise in property taxes. Among municipalities' most disquisitional functions is the provision of constabulary and fire services. Nevertheless, the growth in spending on police and fire pensions has far outpaced the increase in spending on municipal police and fire protection services.

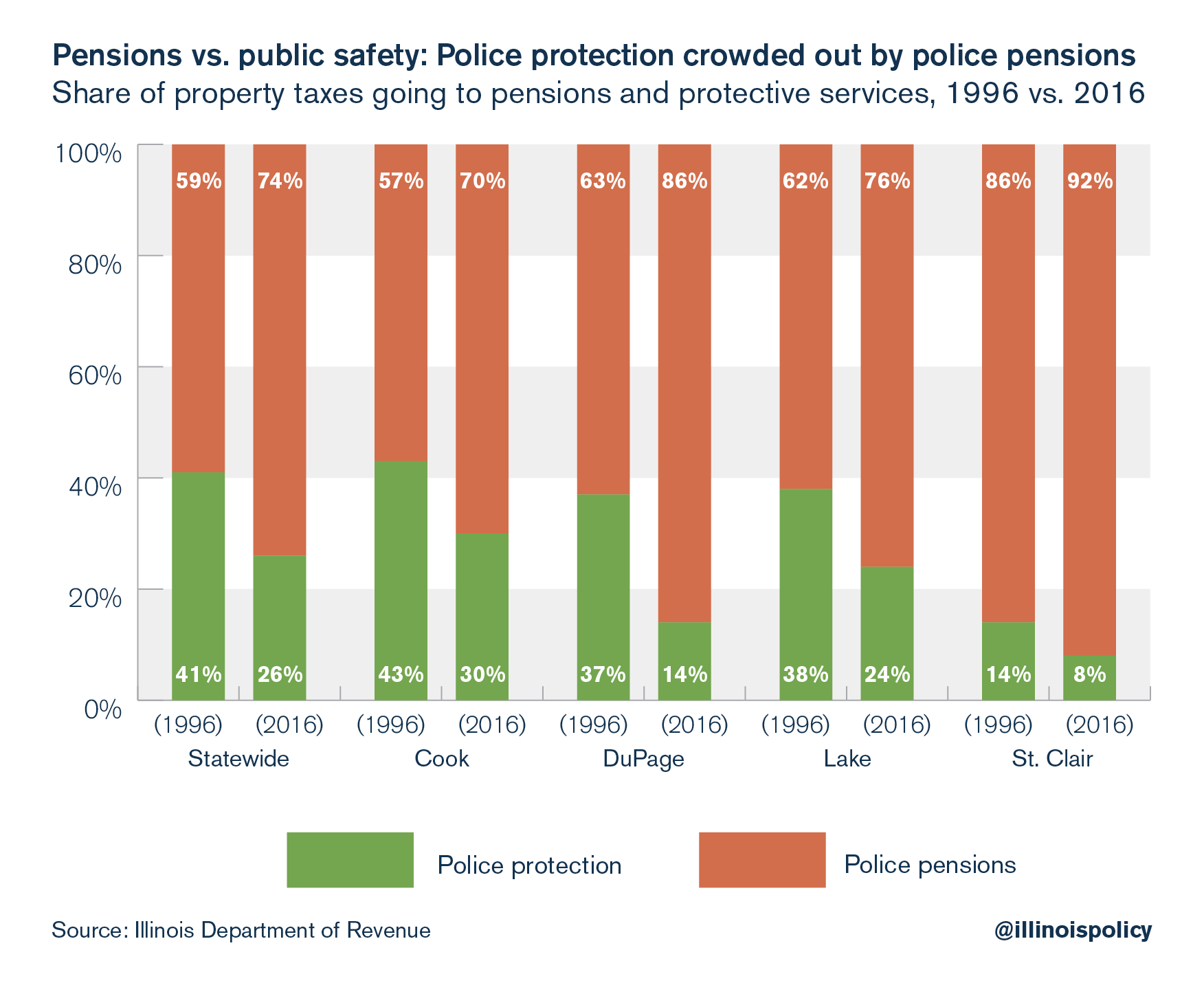

From 1996 to 2016, Illinois belongings taxpayers sent an additional $396 million to police departments, just pensions consumed a vast bulk of these funds. Statewide, 81 cents of every additional belongings tax dollar for police departments – more than $322 million – went to pensions rather than police protection services.

This picture is especially stark in St. Clair and DuPage counties, where 95 percent and 98 percent of boosted funds for police departments went to pensions, respectively.

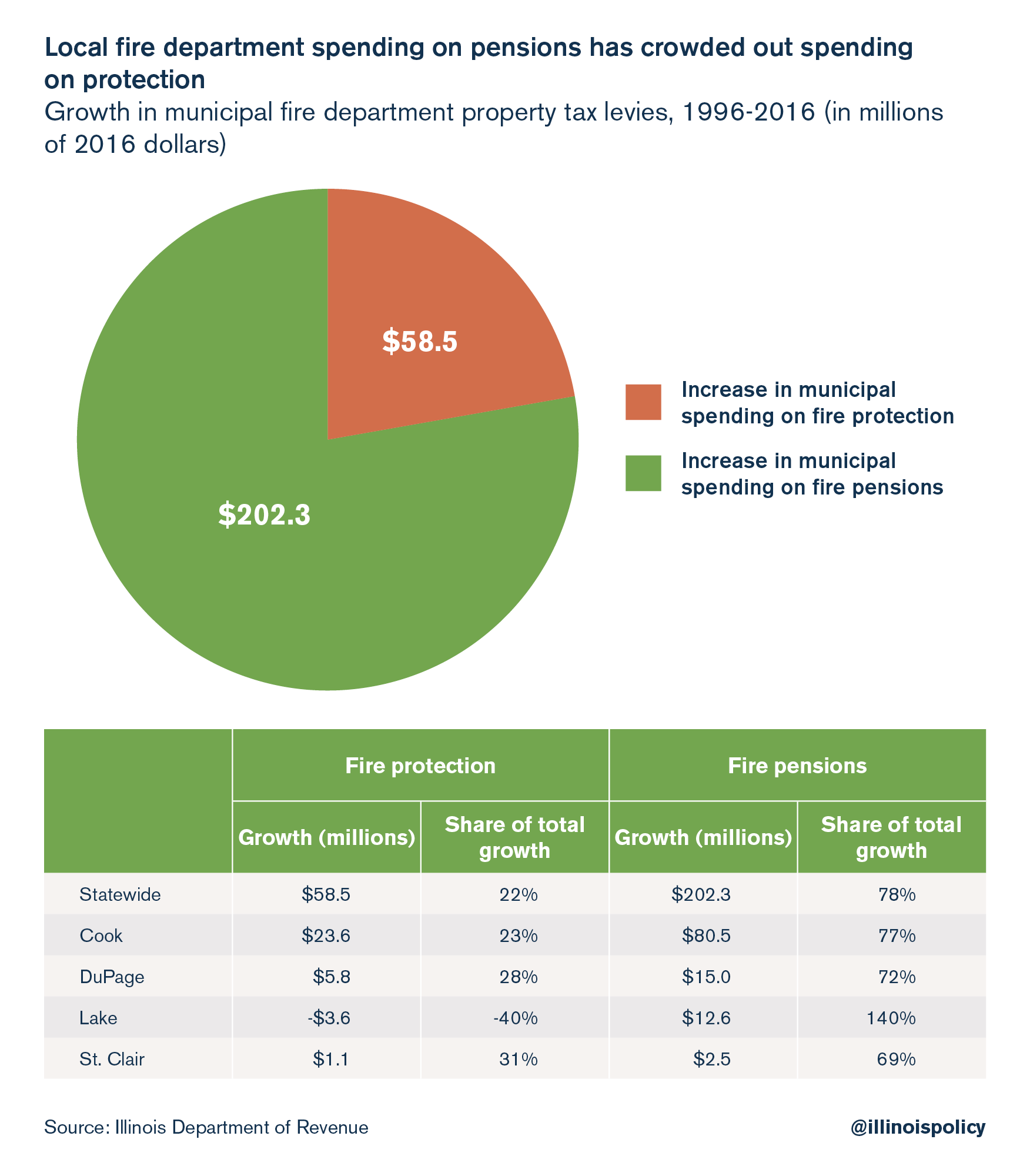

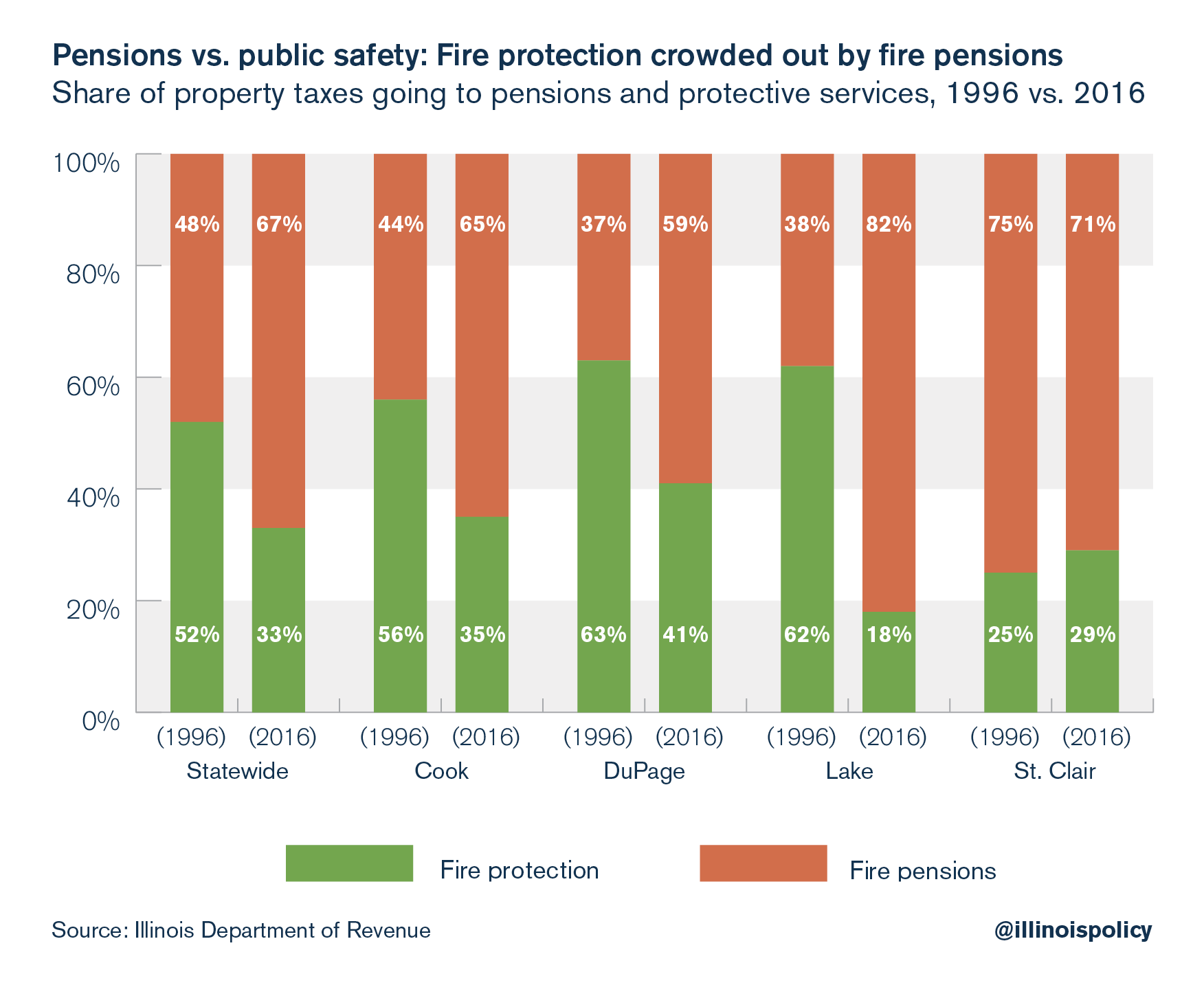

The same tendency holds true for fire departments, which levied an additional $260 meg in property taxes from 1996 to 2016. Most of that money went to pensions. Statewide, 78 cents of every additional belongings tax dollar for municipal fire departments – more than $200 meg – went to pensions rather than fire protection services.

In Lake County, residents saw funding to burn departments cutting by $3.half dozen million while funding for fire pensions increased $12.half-dozen million.

Pensions vs. home values

The increased share of spending on pensions relative to services is reflected in the sluggish growth of dwelling values in Illinois.

All else equal, when rising property tax dollars do non go toward valuable current services, the desirability of a neighborhood does not increase and the return on housing investments declines, making home ownership less appealing. Property taxes enhance the cost of home buying, and if in that location'south government waste product or if the revenue doesn't heighten services, this can depress domicile sales and slow dwelling price appreciation.

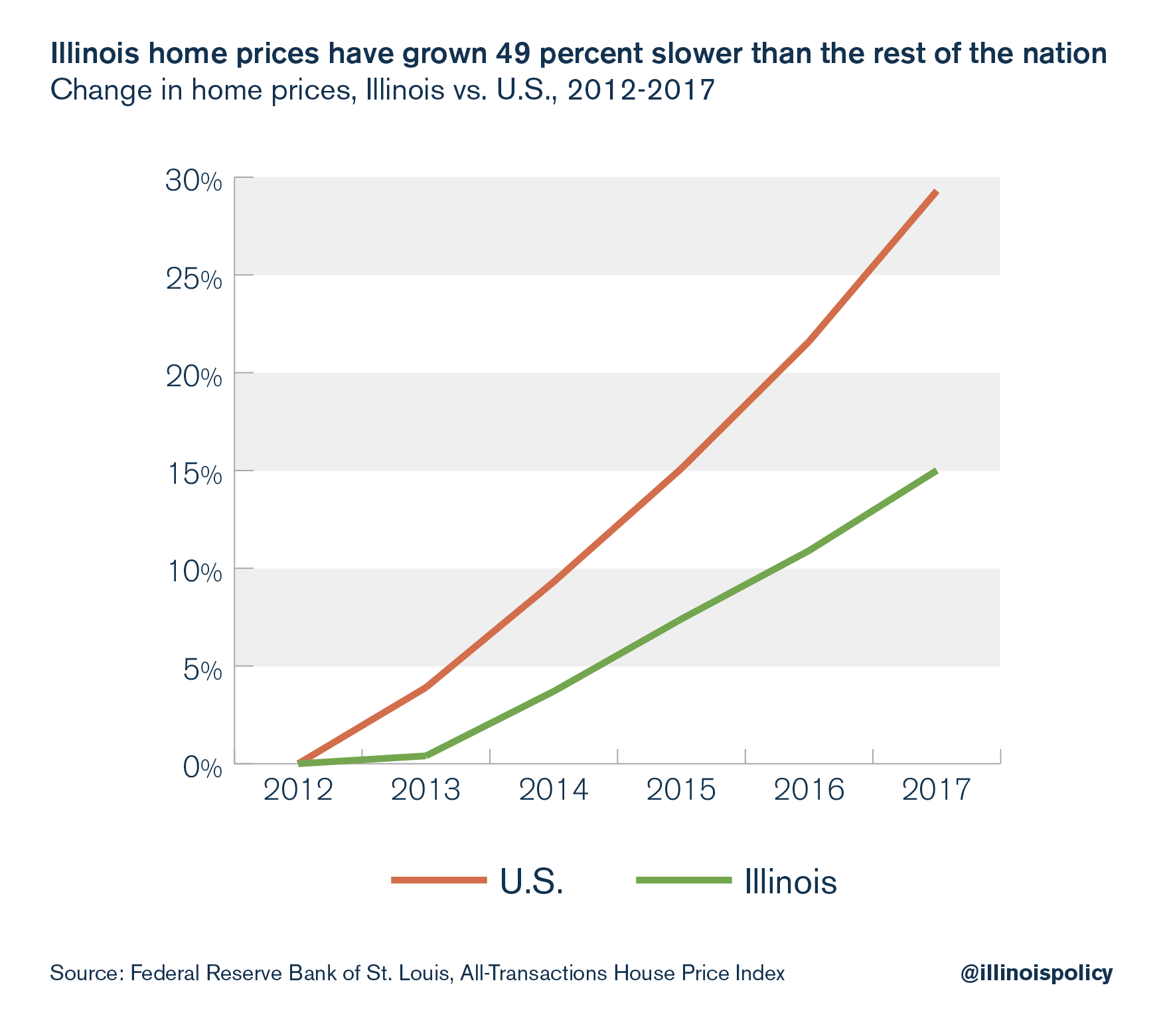

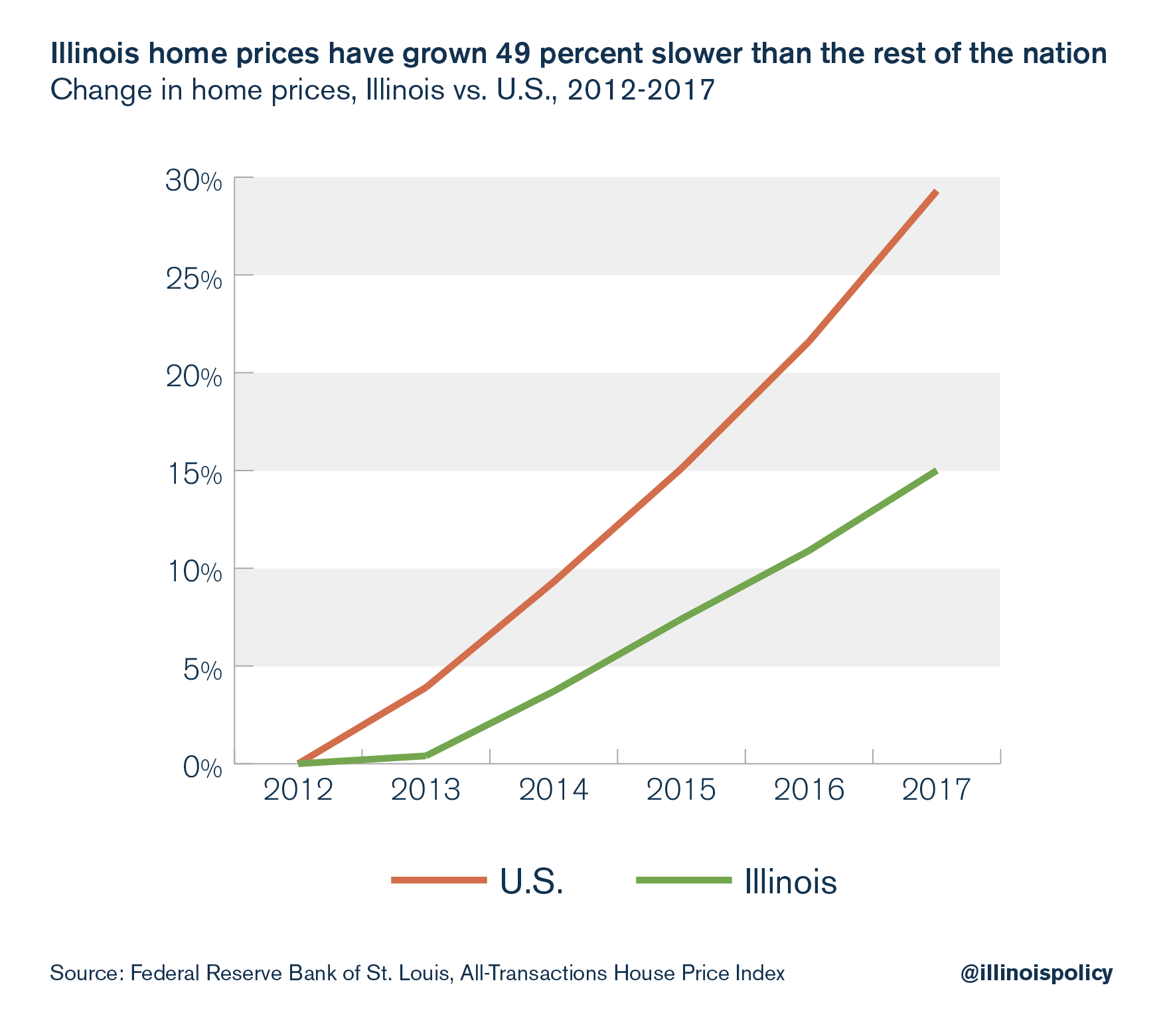

Since the housing market began its recovery in 2012, Illinois home price growth was 49 percent slower than the national boilerplate. Property taxes have been rising faster than home values can keep upwards.

Fixing property taxes ways fixing the pension problem

If Illinois is serious almost providing meaningful property tax relief, the land must deal with its alimony crisis.

If alimony spending had but grown at the rate of inflation since 1996, Illinoisans' property taxation burden would be nearly 20 percent lower than it is today. And if all property revenue enhancement levies grew at the rate of inflation since 1996, Illinois' boilerplate constructive property tax charge per unit would exist hovering merely above the national average at 1.27 pct. (This is without any change in the appreciation of dwelling house values under a less burdensome holding tax system.) Instead, Illinois homeowners are shouldering some of the highest property tax bills amid all l states, with a median effective belongings tax rate of 2.29 per centum.

That burden cannot be lowered without a reduction in the pension liability. Whether in the form of legislation, a constitutional subpoena or a Supreme Court conclusion, property tax relief means a decrease in Illinois' pension liability.

Whatsoever reform that fails to reduce the burden of pension costs on taxpayers will striking Illinoisans via their single largest investment – their homes.

Introduction

The dependence of local governments on belongings taxes has been traditionally justified with the claim that an increase in the taxation charge per unit has piffling to no effect on the revenue enhancement base. One explanation offered for why holding taxes may non atomic number 82 to changes in holding values is that taxes are used to finance public services that may do good homeowners and businesses. When property buying is related to individuals' use of public goods, e.1000., better policing and amend schools, then property taxes can be justified as user fees, implying that it is the provision of amenities, non property taxes, that pb to changes in belongings values.1,2,3,four

In Illinois, property taxes rose 52 percentage between 1996 and 2016, adjusting for inflation.5 However, much of the rise in belongings taxation dollars did non go toward providing benign public services. Instead, a large share of the increase can be attributed to pension contributions at the country and local level. This additional spending does not detect its way to the classroom or toward other essential services. Equally far equally the property taxpayer is concerned, it is substantially wasted.

When additional government spending is wasted, all else equal, college property taxes do not increase the desirability of a neighborhood, leaving housing prices unchanged or even causing them to autumn.vi

As spending on teachers' pensions have increased, country funding for public school classrooms at present makes upwards a smaller share of overall didactics spending. That means local governments must raise property taxes to make up for the share of state funding that is diverted from the classroom. Municipal district levies explicate the next largest share of the rise in Illinois property taxes. Pensions are crowding out the police and fire protection services provided by these districts.

Higher belongings taxes year subsequently year to pay for pensions is a losing proposition for homeowners.

Property taxes and home values

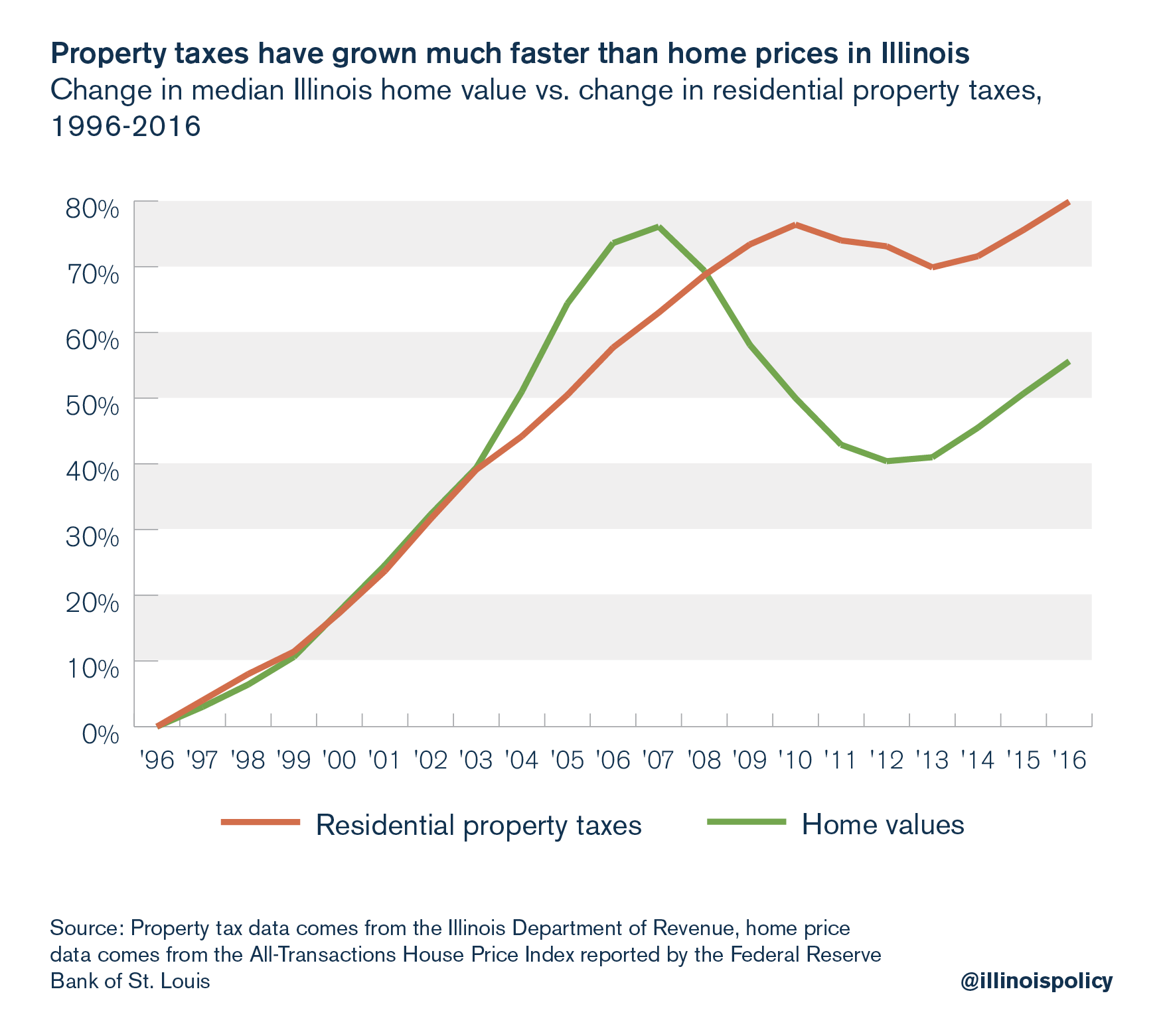

Holding tax extensions have been steadily rising since 1996, and the housing crunch has only exacerbated the hurting that this trend has inflicted on homeowners. According to the Illinois Department of Revenue, holding revenue enhancement extensions increased even while domicile values dropped. Statewide, residential property taxes have grown 43 percentage faster than home values in the by two decades.7

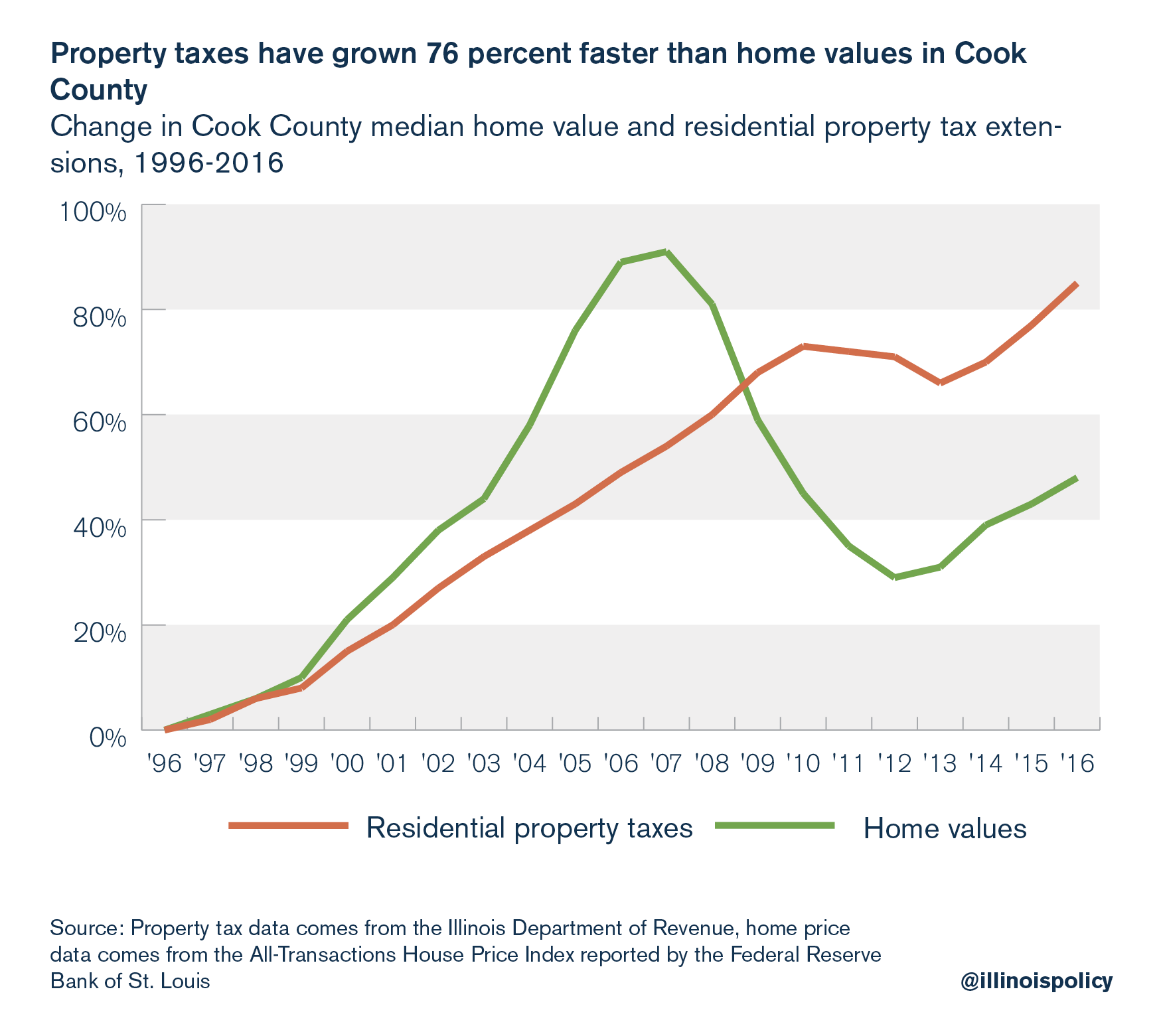

The extent to which property taxes have risen faster varies by county. Since 1996, residential property taxation extensions have grown 76 percent faster than home values in Melt County.

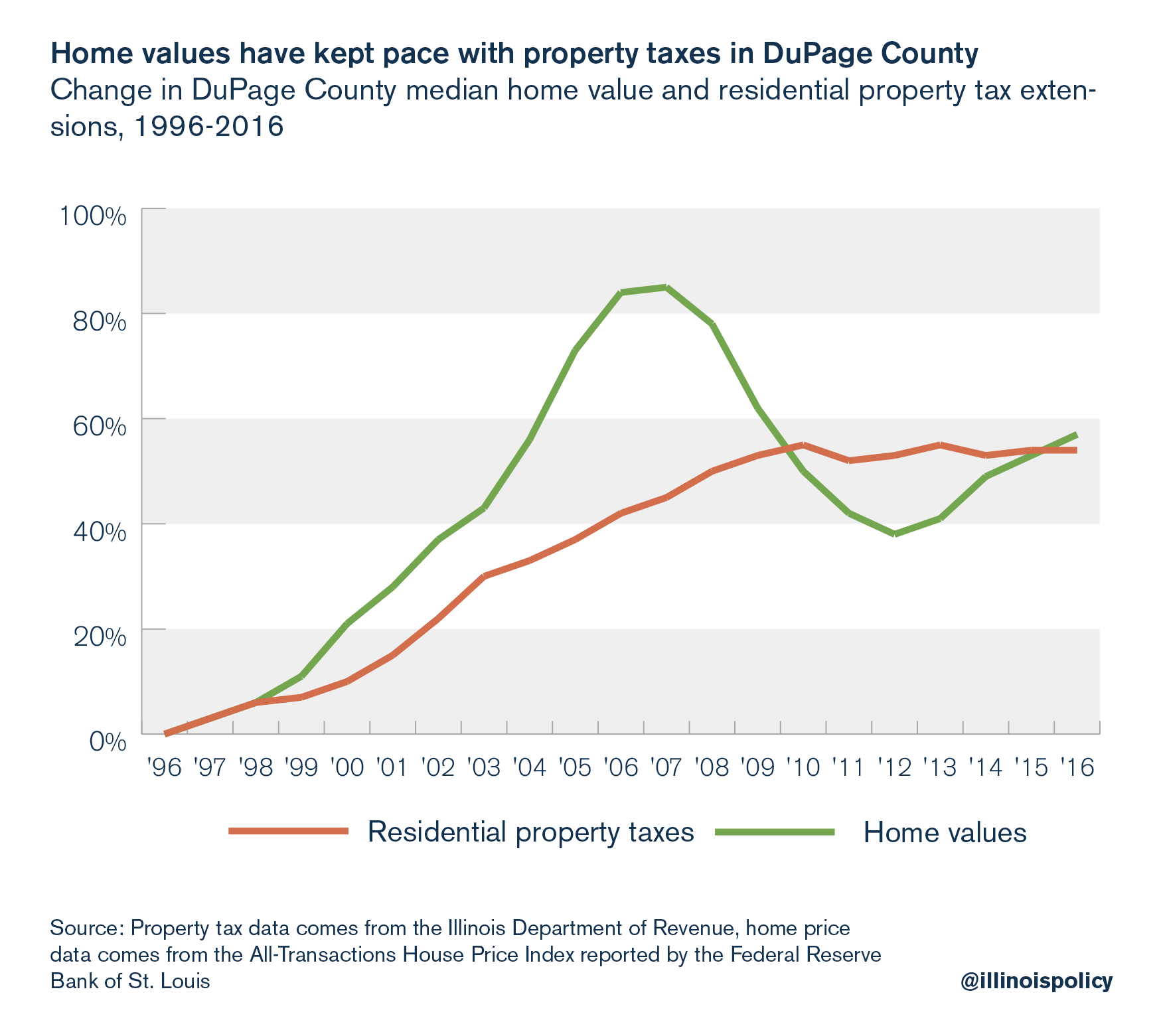

Fortunately for DuPage County, residential belongings taxes have grown slower than home values. This is because local government have put the brakes on property tax levies since the recession, allowing home values to grab up.

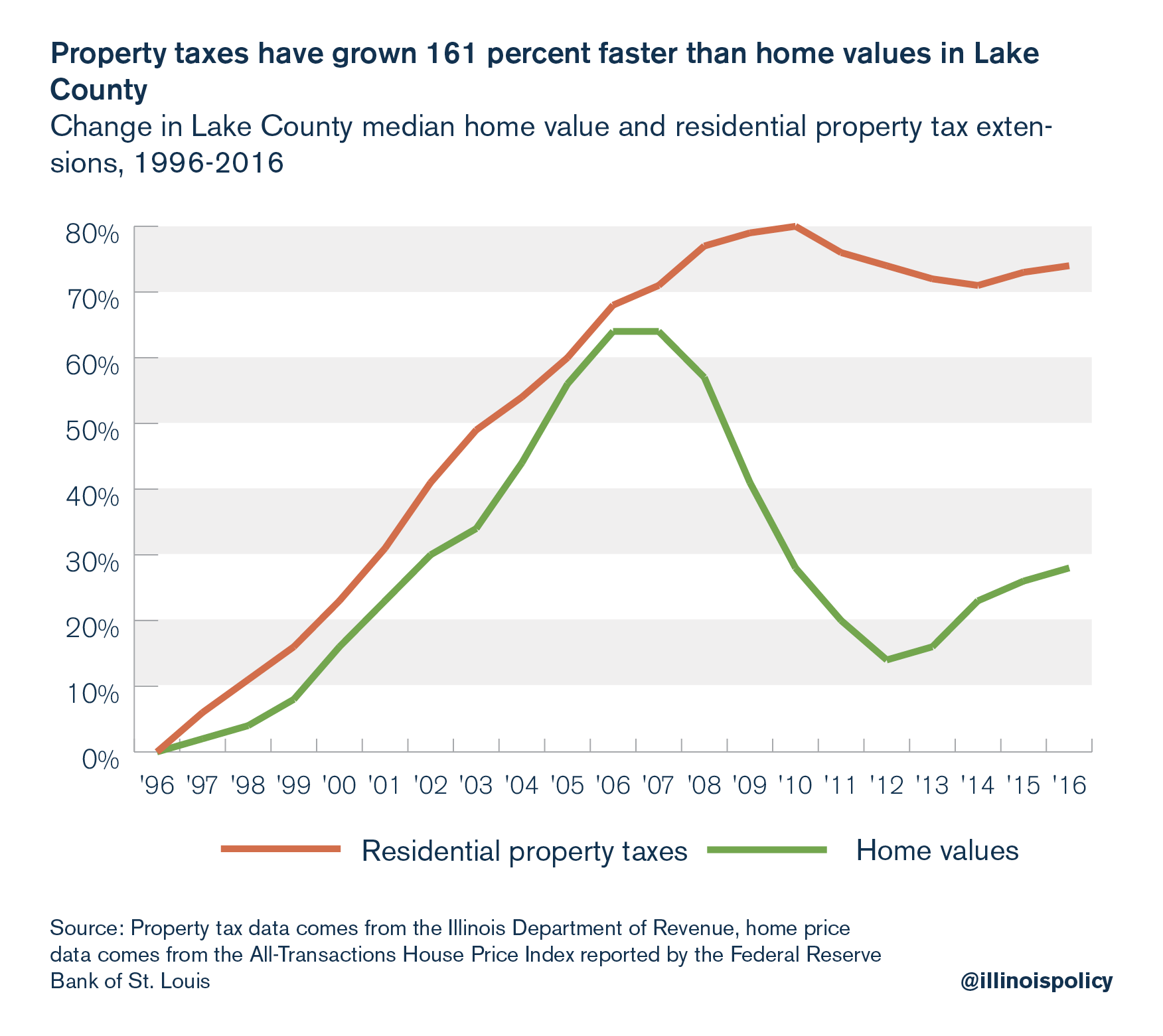

Lake County homeowners saw their property tax extensions rise 161 pct faster than the value of their homes in the past two decades. Fifty-fifty during the housing nail, residential property taxes outpaced home price growth.

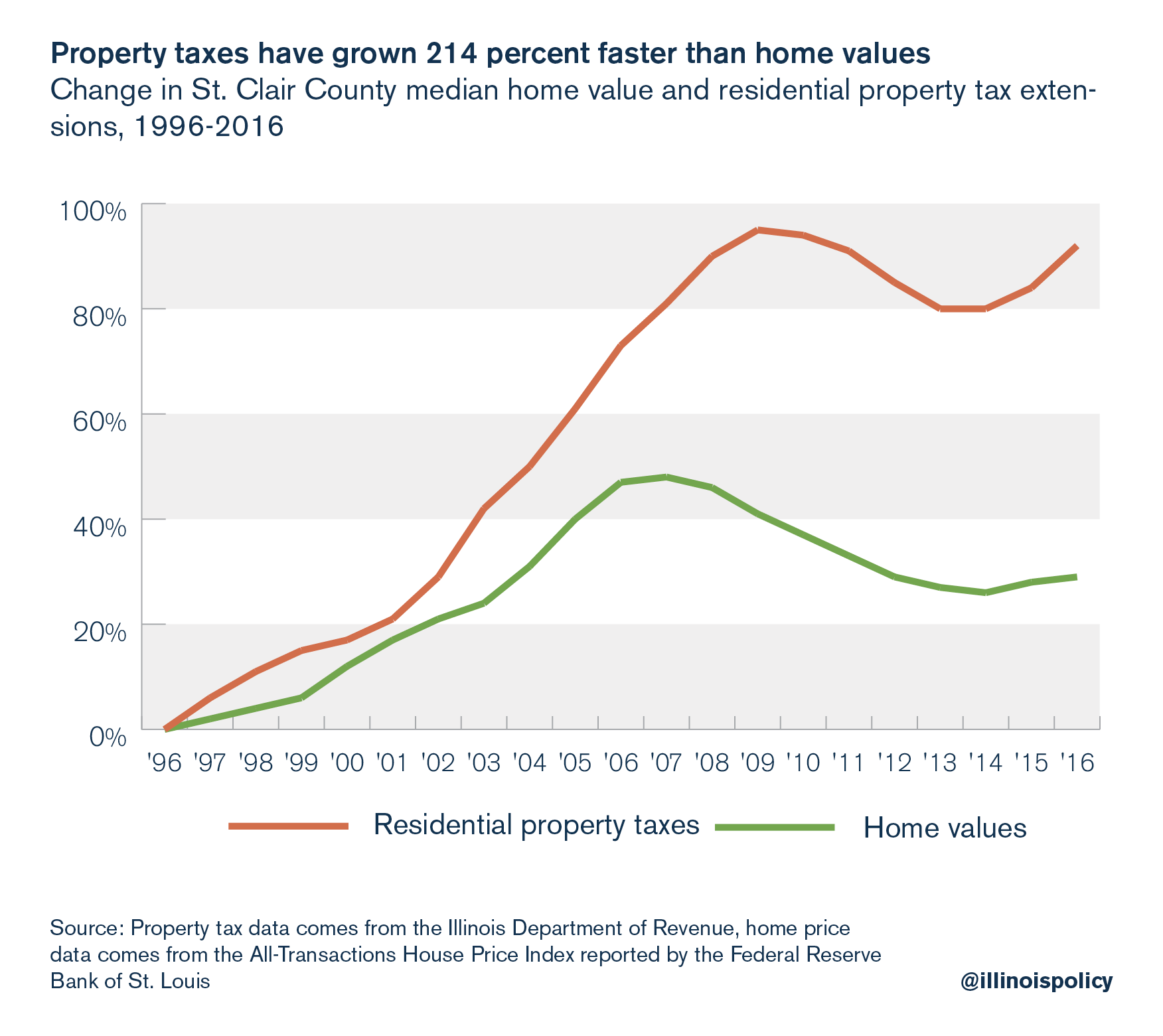

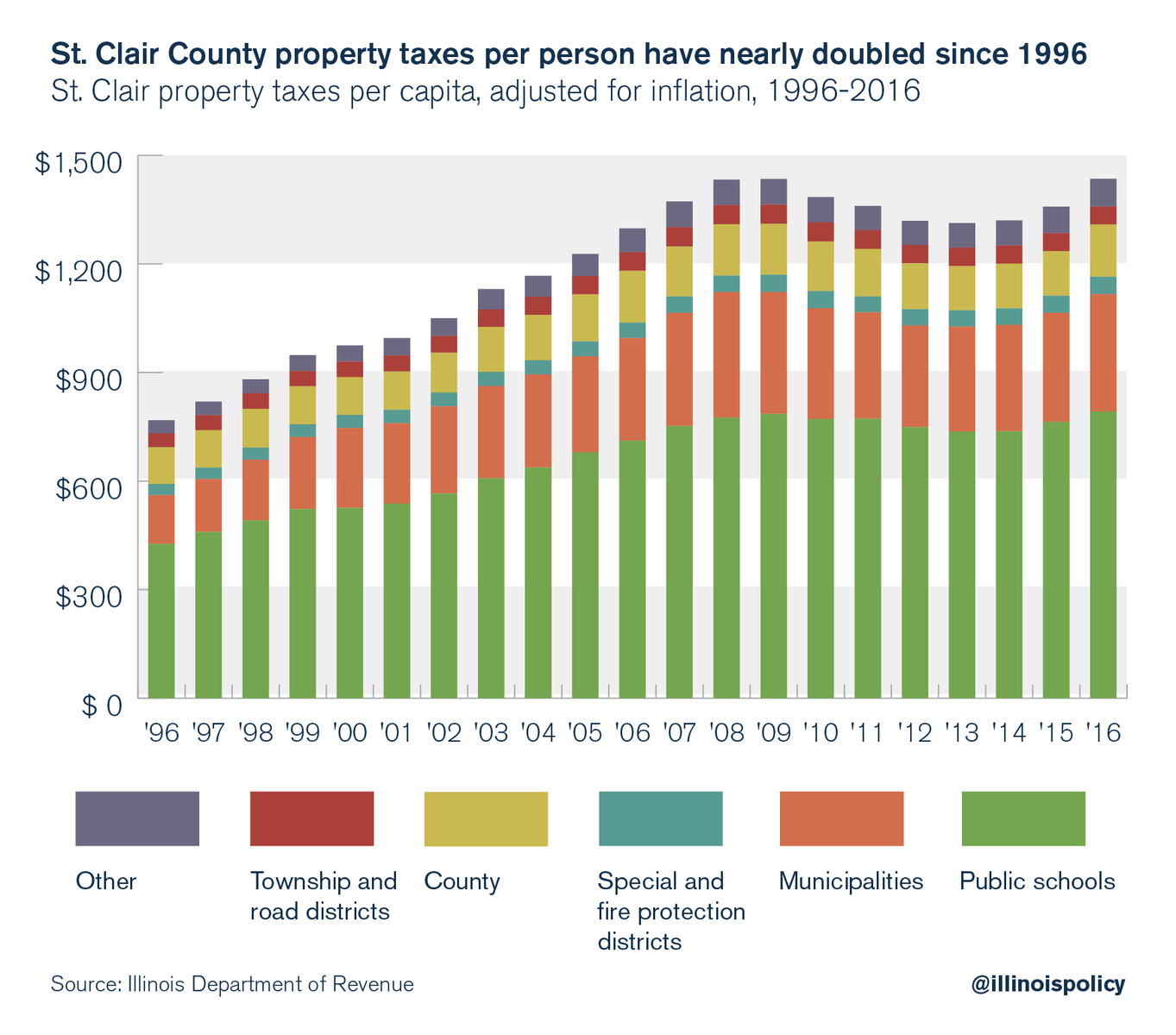

St. Clair County homeowners suffered the well-nigh drastic difference between growth in home prices and belongings taxes in the past xx years, with residential property tax extensions rising 214 percent faster than the value of homes.

Where do Illinoisans' belongings tax dollars become?

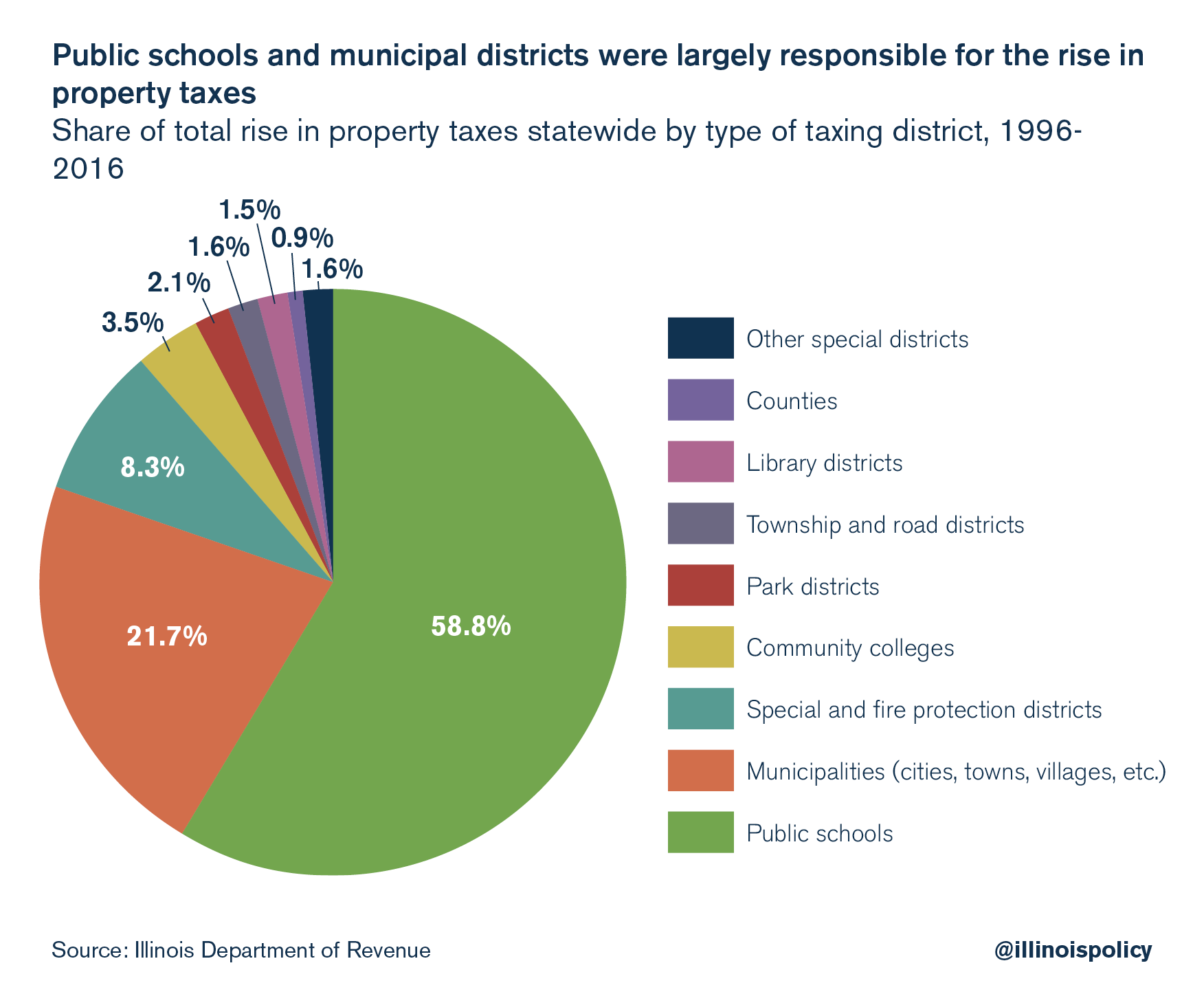

Holding taxes have risen dramatically across the Land of Lincoln over the past 20 years. Statewide, property revenue enhancement extensions rose 52 percentage from 1996 to 2016 when adjusted for inflation, with the rise stemming more often than not from school districts and municipal districts.

Which taxing bodies were responsible for increased property taxes?

Most 59 percentage of the increase in holding taxes went to public schools, 22 per centum went to municipal governments, 8 percent went to special and fire protection districts, three.5 per centum went to community colleges, and the remainder was dispersed between township and route districts, park districts, library districts, other special districts, and canton governments.

The rising in property taxes isn't isolated in but a few counties. Most counties beyond the Prairie Land saw their property taxes skyrocket over the past 20 years.

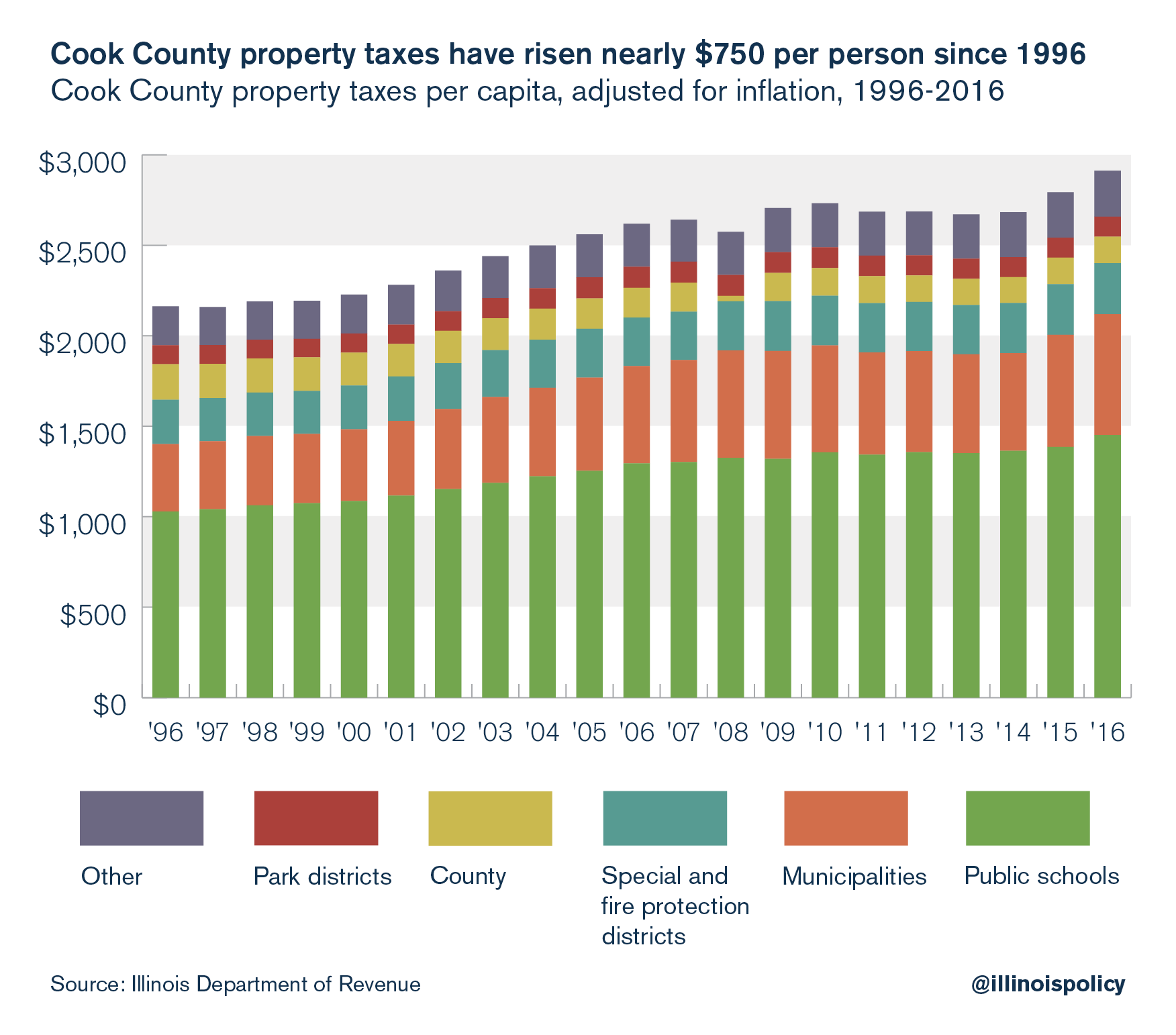

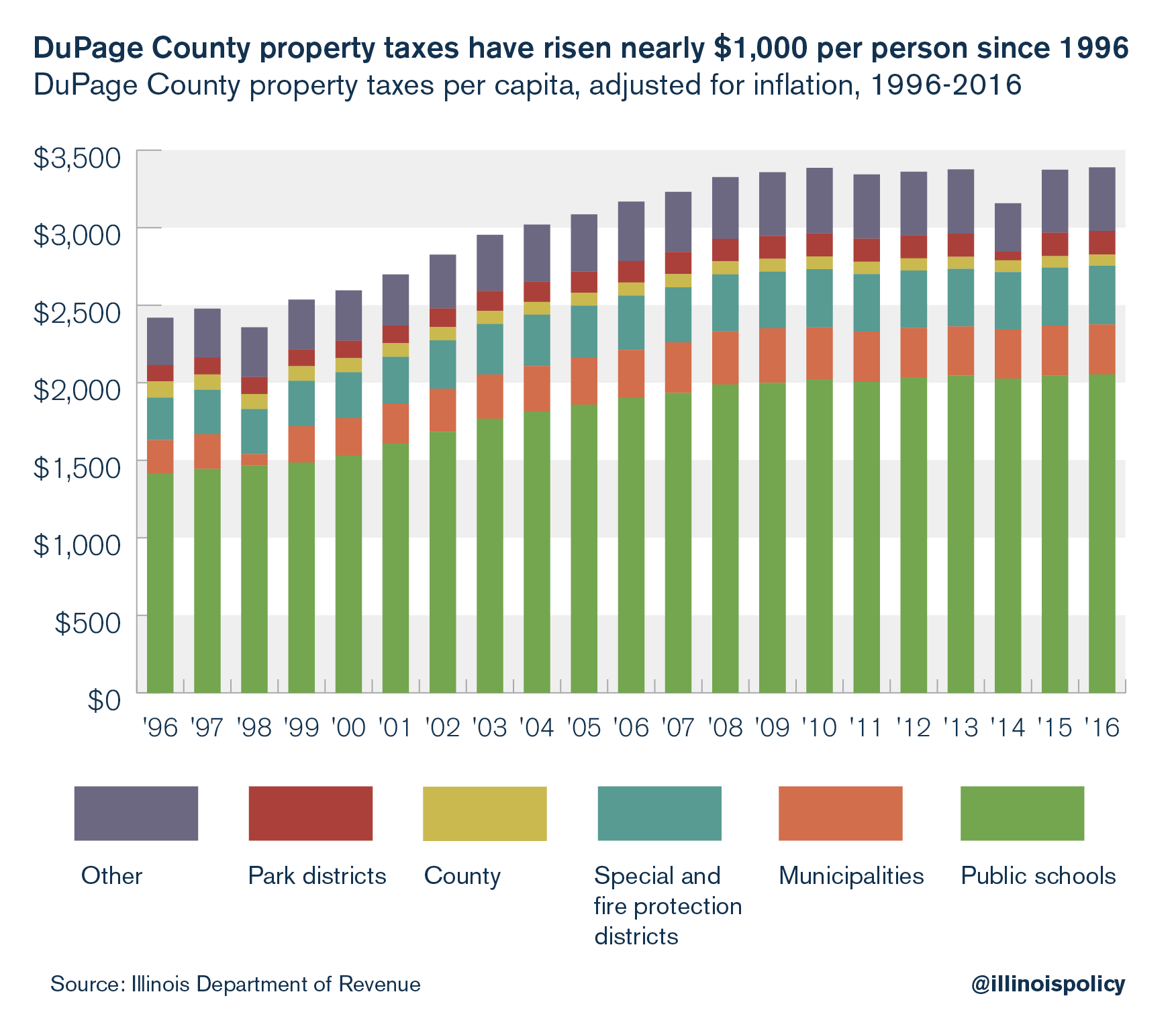

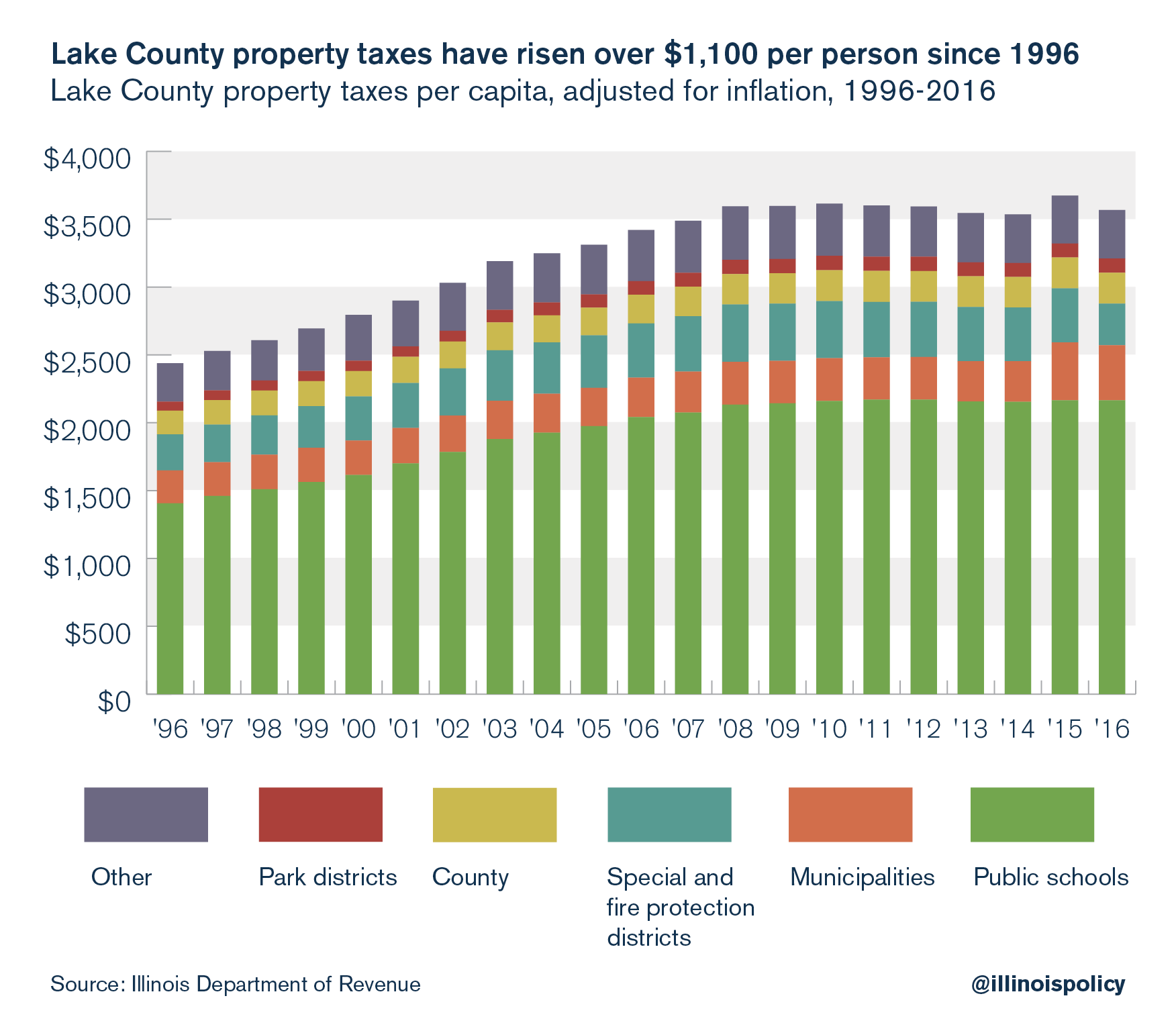

In Cook County, per capita property taxes rose 35 percent faster than aggrandizement from 1996 to 2016; in DuPage Canton that figure is 40 pct. Lake County property taxes accept grown 46 percent faster than inflation and St. Clair County holding taxes have grown the fastest of all four counties, outpacing inflation by 87 percent.8

Where did all of these new revenues become?

Decomposing the growth in property taxes in Cook Canton reveals that public school levies were responsible for 56 percent of the increment in the property taxation brunt, municipal district levies explicate 39 percent while the rest was spent on special districts, park districts, sanitary districts, libraries, forest preserve community colleges and townships.

In DuPage Canton, public school levies were responsible for 69 percent of the increment in the property taxation burden, municipal commune levies explain 11 percent while the remainder was spent on special districts, park districts, sanitary districts, libraries, woods preserves, customs colleges and townships.

In Lake County, public school levies were responsible for 67 percentage of the increase in the property tax burden, municipal commune levies explain fourteen pct while the remainder was spent on special districts, park districts, sanitary districts, libraries, forest preserve community colleges and townships.

In St. Clair Canton, public schoolhouse levies were responsible for 55 percent of the increase in the property tax burden. Municipal commune levies explain 28 percent while the balance was spent on special districts, park districts, sanitary districts, libraries, forest preserve customs colleges and townships.

Pensions are driving up property taxes

Pensions vs. schools

Illinois' property taxes are clearly growing at unsustainable levels. But critics of price-saving reforms claim this is due to the country not contributing enough coin to public education, forcing local school districts to raise their property tax levies. What these critics oft fail to accost, all the same, is the key function of rapidly rising pension costs in how the land is able to fund its schools.

It is the irresponsible growth in teacher pension costs eating up scarce land dollars for pedagogy – not a lack of land money going toward education in general – that is driving local school districts to hike property taxes.

Although school district employees such as teachers and administrators are non state employees, the land regime pays into the Teachers' Retirement System, or TRS, on behalf of school districts. And while the state increased education funding by $v.four billion in the past twenty years, 66 cents of each boosted dollar went to pensions, not schools.

Annual land spending toward TRS has ballooned to about $4.1 billion compared with $514 one thousand thousand 20 years ago.9

Opponents of cost-saving reforms too fail to consider that the state really contributes a larger share of funding toward public schools today than it did twenty years agone, when factoring in alimony spending.

The problem is that pensions now take upward more than a tertiary of the state's contribution to education, compared with just over 8 per centum in the 1996 school year.x

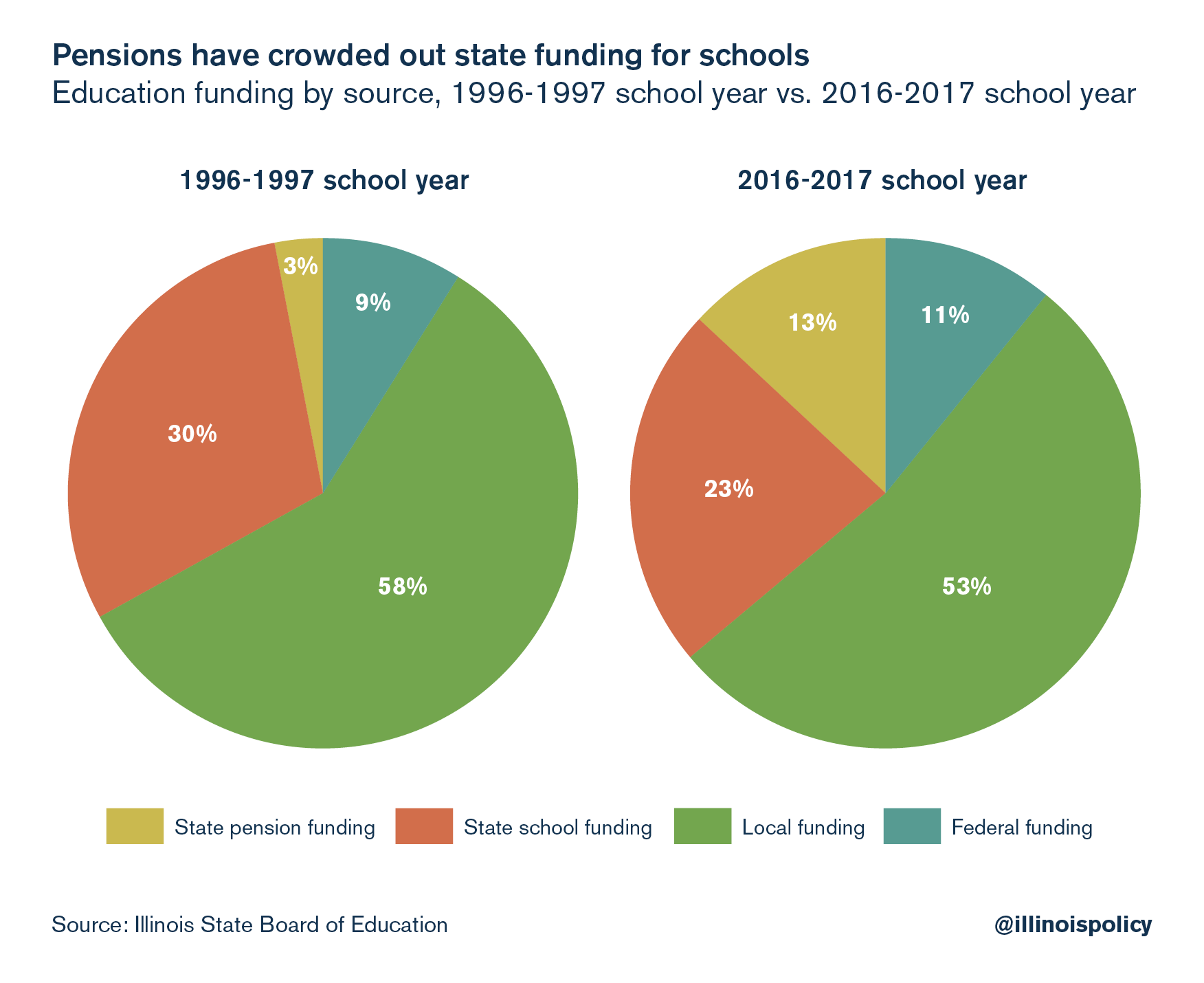

In the 1996-1997 school yr, local governments were responsible for 58 percent of all education funding. Meanwhile, state pension contributions were iii percentage of all spending on teaching, leaving 30 percent of state education spending going directly to schools.11

Past the 2016-2017 schoolhouse year, total state funding of education had climbed to 36 percent from 32 percent in 1996. Just land funding for schools was only 23 percent of all education funding, while state funding for instructor pensions went up to 13 percent of all education funding. Even though local governments are now only responsible for 53 percentage of all expenditures – including pension contributions – the growth in land pension spending has diverted resources the state used to send to schools.12

To put information technology simply, teacher and ambassador pensions are crowding out state didactics funding, and forcing local homeowners to make upward for the shortfall past shouldering an enormous property tax burden. And furthermore, promises of unaffordable benefits have left taxpayers on the hook for increasing unfunded liabilities despite huge influxes of taxation dollars into pension funds.

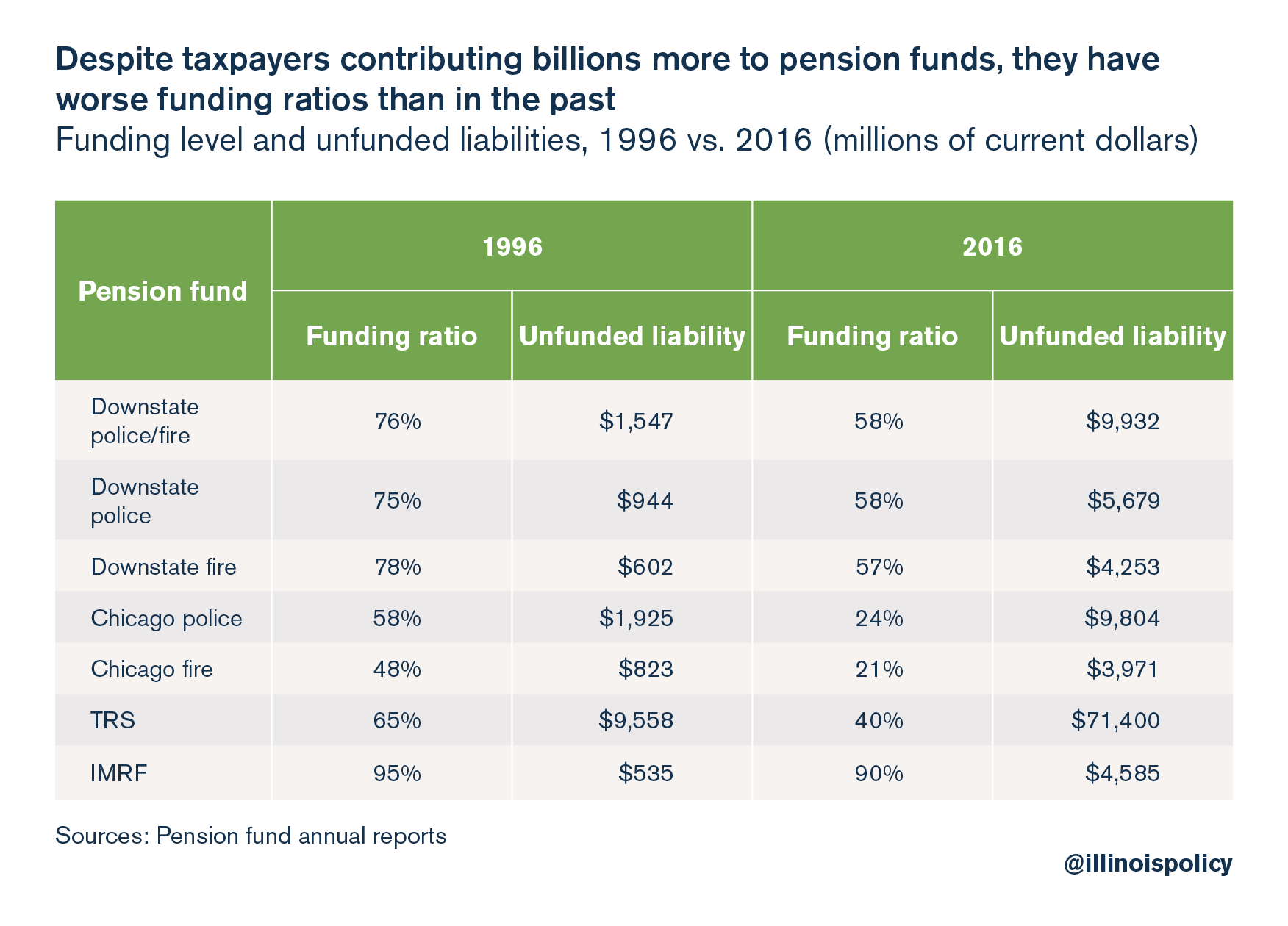

Despite state taxpayers' contributions to TRS increasing 697 pct from the 1996-1997 school year, the alimony organization'south funding ratio grew worse – to forty percent funded in the 2016-2017 school year from nearly 65 percent funded in the 1996-1997 schoolhouse twelvemonth.xiii This is primarily due to automatic cost of living adjustments14 and pension benefit promises rising eight.viii percent every yr since 1987 – an increase of over 1,000 percent over that time bridge.15

Pensions vs. services

If holding revenue enhancement dollars are spent on services that improve communities, home prices should increment with the rise in belongings taxes. But this hasn't been the instance in Illinois, where holding taxes have risen 43 percentage faster than habitation values since 1997. 1 reason for this could be that more than and more of Illinoisans' property tax bills are going to pay for local regime employee pensions every year.

Property taxation dollars that are paid to pensions aren't beingness used to improve or provide public services. To the extent that these contributions go toward payments to current retirees, these revenue enhancement dollars are used to pay for the provision of by services. Additionally, many pensioners no longer – or in some cases never did – alive in the communities they served, so this money is beingness sucked out of those communities entirely, without going toward services that will raise property values.

The share of property taxes that go to public pensions rose 125 percentage in Cook County, 107 percent in DuPage County, 108 pct in Lake County and 93 percent in St. Clair County from 1996 to 2016.

Nearly local regime employees – excluding school teachers, firemen and policemen – pay into the Illinois Municipal Retirement Fund, or IMRF, which has a statutory funding requirement. This requirement ensures that the IMRF alimony share of holding taxes remains relatively constant over time. However, municipal firefighters and municipal police officers take separate alimony funds for each commune, not 1 fund such as the IMRF. Equally a result, these funds exercise not accept the same type of compatible funding requirement16 and accept been historically underfunded. The growth in Illinois' local government pension liabilities has forced many municipalities to increase their pension contributions.

Municipal constabulary departments are spending less and less of the property taxes they collect on protective services, and more on pensions.

Although more property tax dollars were spent on policemen's pensions than on police force protection 20 years agone, the problem has gotten worse. As of 2016, thirty percentage of Cook County property taxation dollars for police departments are spent on police protection. Meanwhile, in St. Clair County, only 8 percentage of property tax dollars paid to police departments are used for protective services and 92 percent are earmarked for pensions.17

This is not to say that municipal spending on police protection services hasn't grown – it has. Simply pension contributions take grown much faster. Adapted for inflation, from 1996 to 2016, Cook Canton spent $35.vi million more on police force protection services, DuPage County spent $0.6 million more, Lake County spent $5.1 million more than, and St. Clair County spent $0.three meg more.18

Notwithstanding, pension costs take grown far more than spending on services. Spending on police force pensions grew past $118.7 million in Melt County, $33.1 meg in DuPage County, $23.6 million in Lake County, and $5.4 million in St. Clair County from 1996 to 2016, adjusting for inflation.19

Municipal fire departments are as well spending less and less of the holding taxes nerveless on protective services, and more than on pensions.

In Lake County, only 18 percent of municipal property tax dollars raised for fire departments is actually spent on protecting the customs from fires.

This is not to say that municipalities aren't spending more money on fire protection than in the past. In fact, they are spending more money on fire protection in each canton examined, except for Lake County. Residents tin await property taxes to go on rising as municipalities try to prevent pensions from crowding out the commitment of local services.

Adapted for inflation, from 1996 to 2016, municipal governments in Cook Canton spent $23.6 million more than on burn down protection services, in DuPage County spent $5.8 one thousand thousand more than, and in St. Clair County spent $ane.i meg more, while those in Lake Canton spent $3.6 million less on fire protection.20

Pension costs have grown far more than than spending on services. Municipal spending on firefighters' pensions grew by $80.5 million in Cook County, $15.1 1000000 in DuPage County, $12.6 meg in Lake Canton and $two.5 million in St. Clair Canton from 1996 to 2016.

The massive growth in pension costs to local taxpayers can help to explain why the increase in their property tax bills has surpassed the increase in the value of their homes. When tax dollars are spent on services that improve the rubber of the community, habitation prices increment because the neighborhood has become a more than desirable destination.21,22,23 Notwithstanding, when tax dollars accept to exist spent on things like pension payments to retirees, which practise non ameliorate local civilities, holding tax hikes can serve to suppress home values.24

The rising price of local government

Local taxing bodies accept been asking for more than and more money from taxpayers over the past 20 years. But where have those additional property tax dollars gone? In brusque, not toward maintaining local services.

While taxpayers look their property tax dollars to provide essential services, only 11 cents of every additional dollar has gone to maintain the 1996 level of services, adjusted for changes in the cost of living and population growth. Meanwhile, 52 percent went to pay for pensions, employee benefits, bonds and involvement, and 37 cents went to other local government spending, which includes things similar additional salaries, expanded payrolls or increased services.25 If Illinoisans today were only getting everything they were getting in 1996 and passed on the savings to homeowners, the average state property tax rate would be cut past more than half.

The corporeality of taxation dollars that exercise not go to services will exercise less to ameliorate habitation values. In fact, a rise in holding taxes without improvements in the quality of services can be detrimental to appreciation in dwelling values. Property taxes should provide for amenities that make neighborhoods an attractive place to buy a home and put downwardly roots, such as public safety and education services. This is non what is happening in Illinois.

Pensions vs. abode values

Municipalities differ enormously in their levels of local public proficient provision and individual investments across Illinois. Some localities have excellent public schools and other public services. Other locations, however, are confronted with appalling public services, less private investment and disuse.

The willingness and ability to pay for these services, likewise every bit preferences for some services over others, varies across households. That ways if property taxes increase, but those additional dollars do non add or improve services, holding values will decrease. This proposition has important implications for the provision of local public services: for example, alimony payments to retirees aren't expected to raise home values equally much as spending on the classroom.

In curt, payments to retirees tin divert spending that would have gone to services that volition improve home values.

While other states are seeing rapid house cost recovery, Illinois housing prices are nonetheless 10 percent beneath their pre-recession levels.26 In 2017, Chicago finished dead last among the 20 largest U.Southward. cities in housing toll growth.27

Housing price growth in Illinois is withal 49 pct below the national average since 2012 (when national domicile prices began rise over again).28

In addition, fourth dimension on the market, or TOM, for sellers in Illinois is even so much higher than the national boilerplate. This longer TOM coupled with declining sales is an indication that in Illinois, families observe purchasing a home less attractive than in other states.

While some experts remain optimistic,29 uncertainty over the country's economic outlook coupled with Illinois' ascension tax burdens dampen toll growth. As the state'south budget problems continue, and the costs of homeownership in Illinois increase, fewer families want to institute roots in Illinois.

Rising property taxes that practise not become toward benign services will depress the value of a family'southward largest investment – a home. Illinois needs to stalk the tide of taxation dollars going toward costs that exercise non improve dwelling values. That means dealing with Illinois' public pensions.

If Illinois wants belongings taxation relief, information technology needs pension reform

If Illinois and its local governments were able to reform their unaffordable pension systems and avoid the looming pension crisis, the state could contribute more than money toward classrooms and reduce its overall spending, and localities could provide belongings taxation relief.

The implication is clear: Illinois lawmakers cannot seriously talk well-nigh holding taxation relief without addressing the pension trouble. Homeowners are seeing less for their holding tax dollars considering pensions take a growing piece of the pie.

If Illinoisans want property tax relief without cut services, state and local governments need to reduce taxpayers' share of the alimony burden.

So far, the Illinois Supreme Court has been unwilling to allow whatsoever reforms in electric current pensions. It is increasingly clear that the merely risk Illinoisans have is to amend the Illinois Constitution.

The state must be able to make reasonable adjustments to public pensions that reverberate the fiscal situation in Illinois. Since the constitution does not permit citizen initiatives to ameliorate the pension clause, any amendment must be canonical by iii-fifths of the General Assembly – and later on approved past voters at the ballot box.thirty

Every bit Illinoisans expect for an end to the alimony nightmare, they are racking up revenue enhancement bills that increasingly do non go toward educating their children or protecting their safety, their homes, or their own retirements. The provision of services is already suffering in some municipalities because of this trouble. This twelvemonth, the city of Harvey laid off police force officers and firefighters in club to cover a courtroom-ordered pension payment.31

At some betoken, enforcing the pension protection clause violates the obligation the country has to protect the rights of its citizens at large, depriving them of the most fundamental government services.

Public pensions have been overpromised and underfunded.32 That said, taxpayers were never going to be able to afford 3 percent automated annual cost of living adjustments33 or benefit promises that compound 8.eight percent every twelvemonth.34 Due to these unsustainable benefits provided in the divers-benefit plans given to public workers, taxpayers are forced to pay more of their tax dollars to pensions every year. Despite contributing 697 percent more to teacher pensions, 300 pct more to policemen and firemen'south pensions, and 38 percent more to the IMRF, these alimony funds have go less and less solvent.

Politicians' overpromising has left taxpayers on the hook for massive unfunded liabilities. In the by 20 years, taxpayers have contributed billions of dollars to these pension funds, yet their funding ratios are significantly lower. If this trend continues, taxpayers volition be left holding the bag – forced to pay more in income and property taxes each year for little in return.

Conclusion

Illinois homeowners are in drastic demand for property tax relief. Over the past decades, Illinois property taxes rose even while dwelling house values struggled to recover. State and local regime employee alimony costs largely drove those rising tax bills. Pensions have crowded out state spending in education and local spending on police and burn services, and the burden to pay those extra costs has fallen on homeowners.

If Illinois is serious about providing meaningful property tax relief, the country must deal with its pension crisis. Whether in the form of legislation, a constitutional amendment or a Supreme Court conclusion, property taxation relief can only happen aslope a decrease in Illinois' pension liability.

Any reform that fails to reduce the brunt of alimony costs on taxpayers ignores the root of the problem. Whatever meaningful property revenue enhancement relief for Illinoisans means reforming Illinois' unsustainable public pension system.

Endnotes

- Dennis Carlton, "Why New Firms Locate Where They Do: An Econometric Model," Interregional Movements and Regional Growth (Washington D.C.: The Urban Institute, 1979).

- Timothy Bartik, "Business Location Decisions in the United States: Estimates of the Furnishings of Unionization, Taxes and Other Characteristics of States," Journal of Concern and Economic Statistics, no.3 (1985).

- Ronald C. Fisher, Timothy J. Bartik, Harley T. Duncan, Therese McGuire, and Robert M. Ady, "The effects of land and local public services on economic evolution," New England Economic Review (1997): 53.

- Yard. Wasylenko, "Taxation and economic development," New England Economic Review (March/April 1997): 37-52.

- Illinois Policy Institute calculations using information from the Illinois Department of Revenue.

- C. Bai, Q. Li, and M. Ouyang, "Property taxes and home prices: A tale of two cities," Journal of Econometrics 180, no.1 (2014): i-15.

- Illinois Policy Institute calculations based on Illinois Department of Revenue Property Taxation data and the All-transactions House Price Index provided past the Federal Reserve Bank of St. Louis.

- "Property Tax Statistics," Illinois Department of Revenue.

- Ibid.

- 2016 Annual Report, Illinois Country Board of Educational activity, January 2017.

- Ibid.

- Ibid.

- Annual Financial Report Summary, Instructor's Retirement System of the State of Illinois, 2017.

- Ted Dabrowski and John Klingner, "What'south driving Illinois' $111 billion alimony crunch: Retirement ages, COLAs, and out of sync pension payments," Illinois Policy Institute, April 2016.

- Ted Dabrowski, "Illinois pensions: Overpromised, not underfunded," Madison-St. Clair Tape, February 6, 2018.

- 40 ILCS 5/vii-172.i

- "Belongings Tax Statistics," Illinois Department of Revenue.

- Ibid.

- Ibid.

- Ibid.

- Leigh Linden and Jonah Due east. Rockoff, "Estimates of the Bear on of Crime Run a risk on Property Values from Megan'southward Laws," American Economic Review 98, no.iii (2008): 1103-27.

- Allen Lynch and David Rasmussen, "Measuring the impact of offense on house prices," Journal of Practical Economics 33, no.15 (2001): 1981-1989.

- Richard Thaler, "A notation on the value of crime control: Evidence from the property market," Periodical of Urban Economics 5, no.one (Jan 1978): 137-145.

- Bai, Li, and Ouyang, 2014.

- Illinois Policy Institute calculations using data from the Illinois Department of Revenue and the Illinois Land Board of Education.

- All-Transactions Firm Price Index.

- "S&P CoreLogic Case-Shiller Home Cost Indices," 2018.

- All-Transactions Firm Price Index.

- "Housing Price Forecasts Illinois and Chicago PMSA, March 2018," Regional Economic science Applications Laboratory, March 21, 2018.

- IL Const. Art. Thirteen, § 5; Fine art. Fourteen, § 3.

- Adam Schuster, "Harvey pension crisis leads to mass layoffs," Illinois Policy Institute, Apr xi, 2018.

- Ted Dabrowski and John Klingner, "Illinois Country Pensions: Overpromised, not underfunded – Wirepoints Special Report," Wirepoints, March 29, 2018.

- Dabrowski and Klingner, "What's driving Illinois' $111 billion, pension crisis" 2016.

- Dabrowski, "Illinois pensions: Overpromised, not underfunded."

Source: https://www.illinoispolicy.org/reports/pensions-make-illinois-property-taxes-among-nations-most-painful/

0 Response to "besides cook county taxes what other taxes to home owners have to budget for?"

Post a Comment